Looking for a business loan without collateral? Godrej Finance offers flexible unsecured loans for self-employed professionals and business owners. Here’s a simple breakdown of eligibility, loan options, and how to apply.

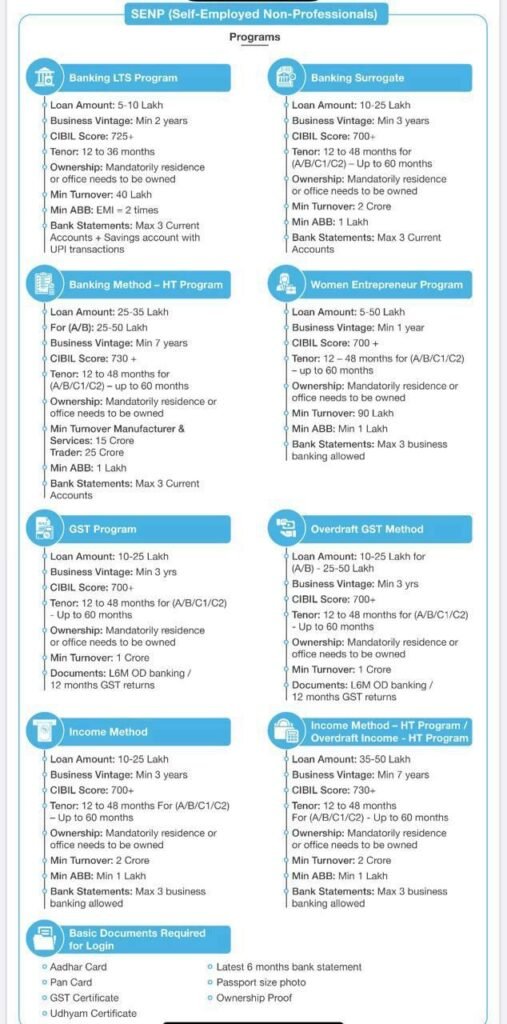

📌 Quick Loan Overview

| Feature | Details |

|---|---|

| Loan Type | Unsecured (No Collateral Needed) |

| Loan Amount | ₹5 Lakh – ₹50 Lakh |

| Tenure | 12 – 60 Months |

| Interest Rate | Competitive (Based on Profile) |

| CIBIL Score | 700+ (Varies by Program) |

| Ownership | Must Own Residence or Office |

| Documents | Aadhar, PAN, GST, Bank Statements |

💡 Who Can Apply?

✔ Self-Employed Professionals & Business Owners

✔ Minimum Business Vintage – 1 to 7 Years (Depends on Loan Type)

✔ Minimum Turnover – ₹40 Lakh to ₹25 Cr (Varies by Program)

✔ Age – 25+ Years (Standard)

💰 Loan Programs – Simplified

1️⃣ Banking LTS Program (Small Businesses)

- Loan: ₹5L – ₹10L

- Business Age: 2+ Years

- CIBIL: 725+

- Turnover: ₹40L+

- Banking: Max 3 Accounts + UPI Transactions

2️⃣ High-Ticket (HT) Program (Established Businesses)

- Loan: ₹25L – ₹50L

- Business Age: 7+ Years

- CIBIL: 730+

- Turnover:

- Manufacturers/Services: ₹15 Cr

- Traders: ₹25 Cr

3️⃣ Quick Sanction Term (QST) Loan

- Loan: ₹10L – ₹25L

- Business Age: 3+ Years

- CIBIL: 700+

- Documents: 6 Months OD Banking / 12 Months GST

4️⃣ Women Entrepreneur Program

- Loan: ₹5L – ₹50L

- Business Age: 1+ Year

- CIBIL: 700+

- Turnover: ₹90L+

5️⃣ Overdraft (GST-Based) Loan

- Loan: ₹10L – ₹50L

- Business Age: 3+ Years

- CIBIL: 700+

- Documents: 6 Months OD Banking / 12 Months GST

📝 Key Eligibility Conditions

✔ CIBIL Score – 700+ (Higher for some programs)

✔ Business Stability – 1-7 Years (Depends on loan type)

✔ Bank Statements – Last 6-12 Months (Varies by program)

✔ Ownership Proof – Must own residence or office

📋 Basic Documents Required

- KYC: Aadhar, PAN

- Business Proof: GST Certificate, Udhyam Registration

- Bank Statements: 6-12 Months

- Ownership Proof (Residence/Office)

🚀 How to Apply?

1️⃣ Check Eligibility – Match your profile with the loan programs.

2️⃣ Gather Documents – Keep KYC, GST, and bank statements ready.

3️⃣ Apply Online/Offline – Visit Godrej Finance website or branch.

4️⃣ Get Approval – Fast processing (subject to verification).

💡 Tips for Higher Approval Chances

✔ Maintain a CIBIL score of 700+.

✔ Ensure clean banking history (no bounces).

✔ Keep GST filings updated (if applicable).

✅ Why Choose Godrej Finance?

- No collateral required.

- Flexible repayment (up to 60 months).

- Special schemes for women entrepreneurs.

Need help? Drop your questions below! 🚀